Modeling subscription churn

Statwonk

May 22, 2016

Note: this is a work in progress please send feedback to @statwonk

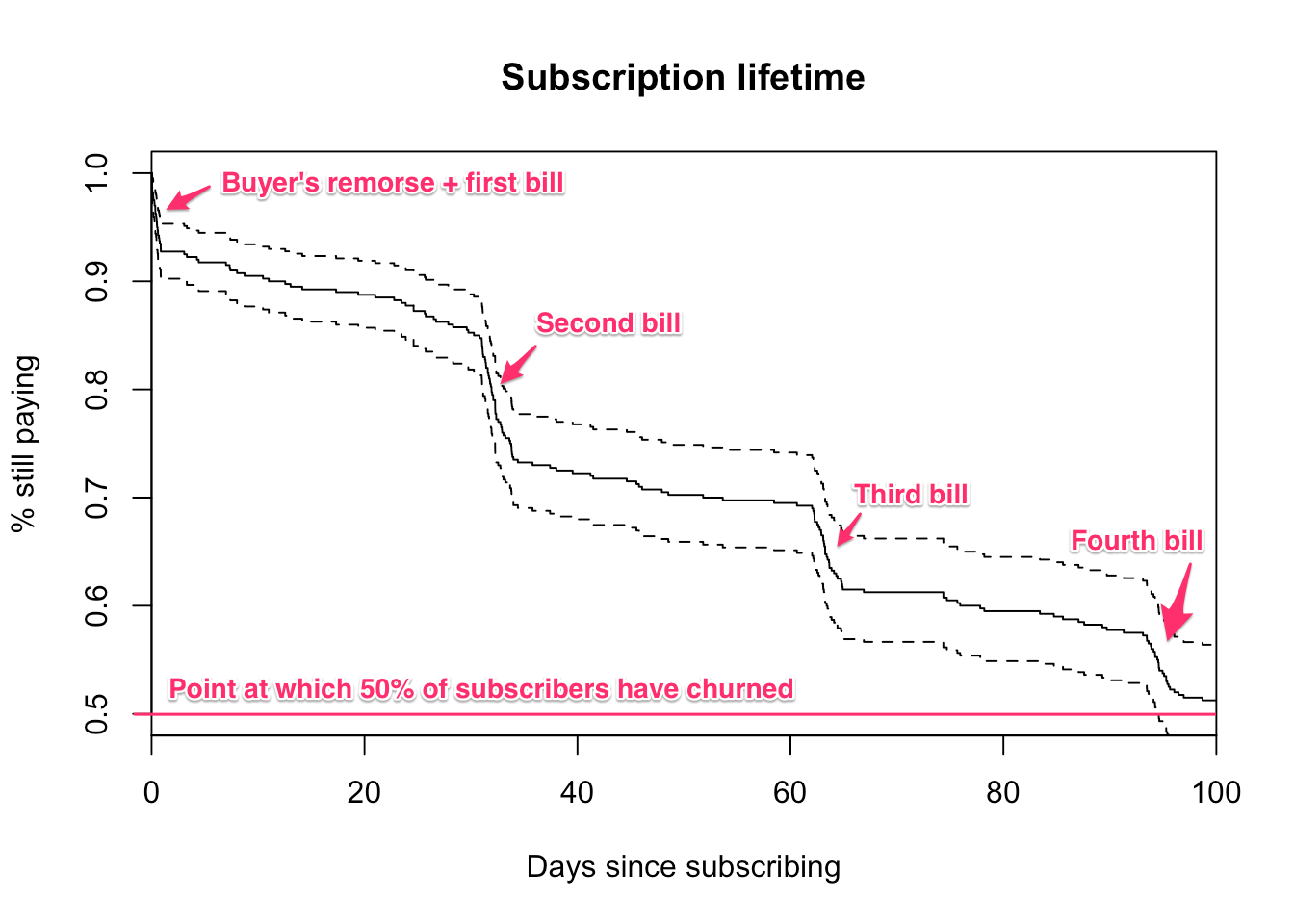

Subscription churn usually clusters around the first day and each subsequent bill. “Buyers remorse” is a common phrase for early churn and it’s no surprise that subscribers churn when presented with a bill. It’s important to model these clusters well because they’re where most customers churn.

Let’s generate some toy data reflecting this common business scenario.

library(eha)

example_hazard_rates <- c(

0.06, # buyer's remorse

0.003,

0.055, # second bill

0.002,

0.05, # third bill

0.002,

0.04, # fourth bill

0.004)

# It seems that the eha::rpch function has a little bug

# with failing to pass the cuts, levels params. This is

# a quick fix.

# First generate piecewise-constant survival data

rpch <- function(n, cuts, levels) {

x <- runif(n)

qpch(x, cuts, levels)

}

x <- data.frame(

times = rpch(

n = 400,

cuts = c(1, # initial purchase

31, 34, # second bill

62, 65, # third bill

93, 96 # fourth bill

),

levels = example_hazard_rates

),

censor = 1

)

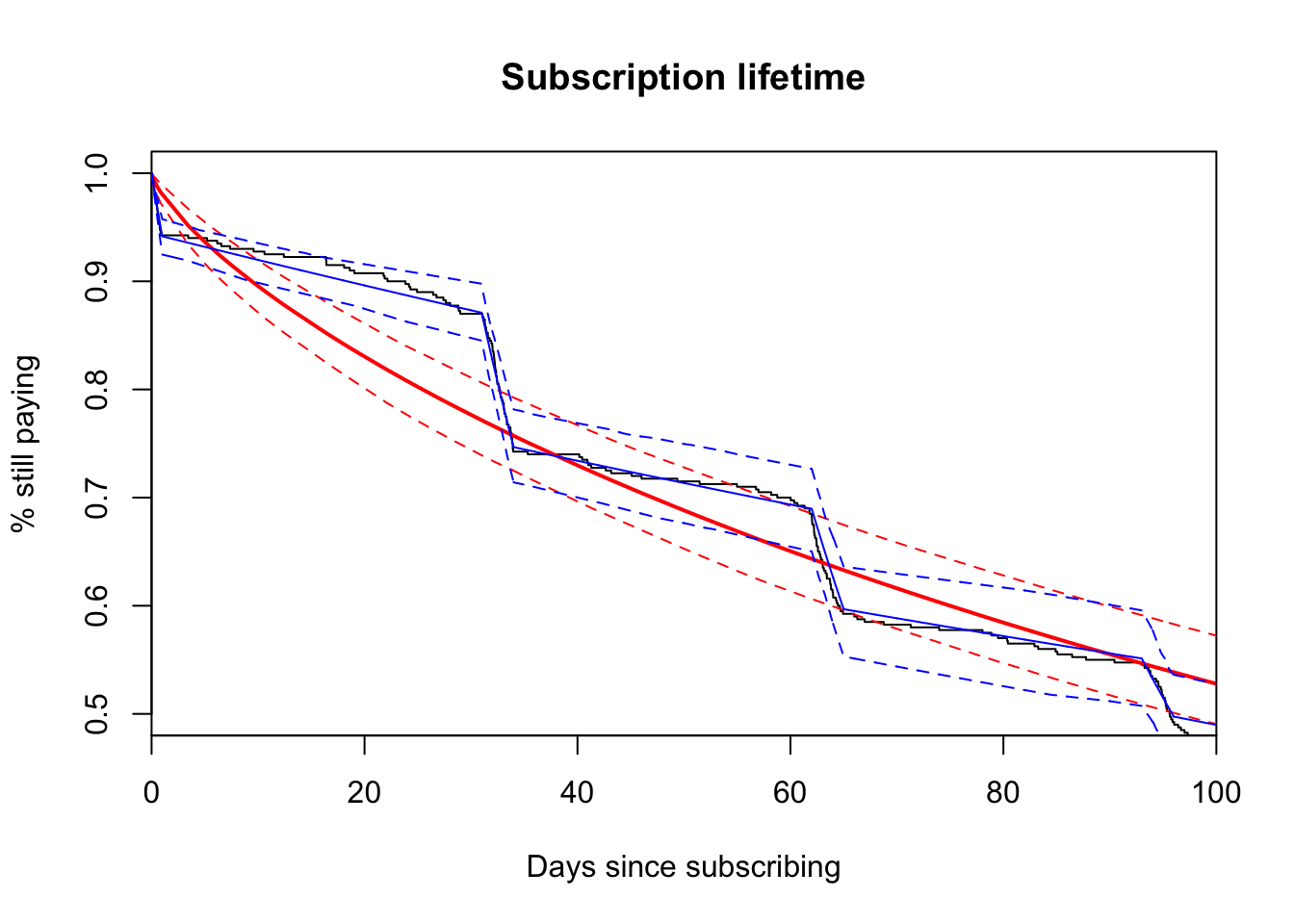

plot(

survfit(Surv(times, censor) ~ 1, data = x),

xlim = c(0, 100),

ylim = c(0.5, 1),

conf.int = TRUE,

main = "Subscription lifetime",

ylab = "% still paying",

xlab = "Days since subscribing"

)

Alright, now we have our toy dataset.

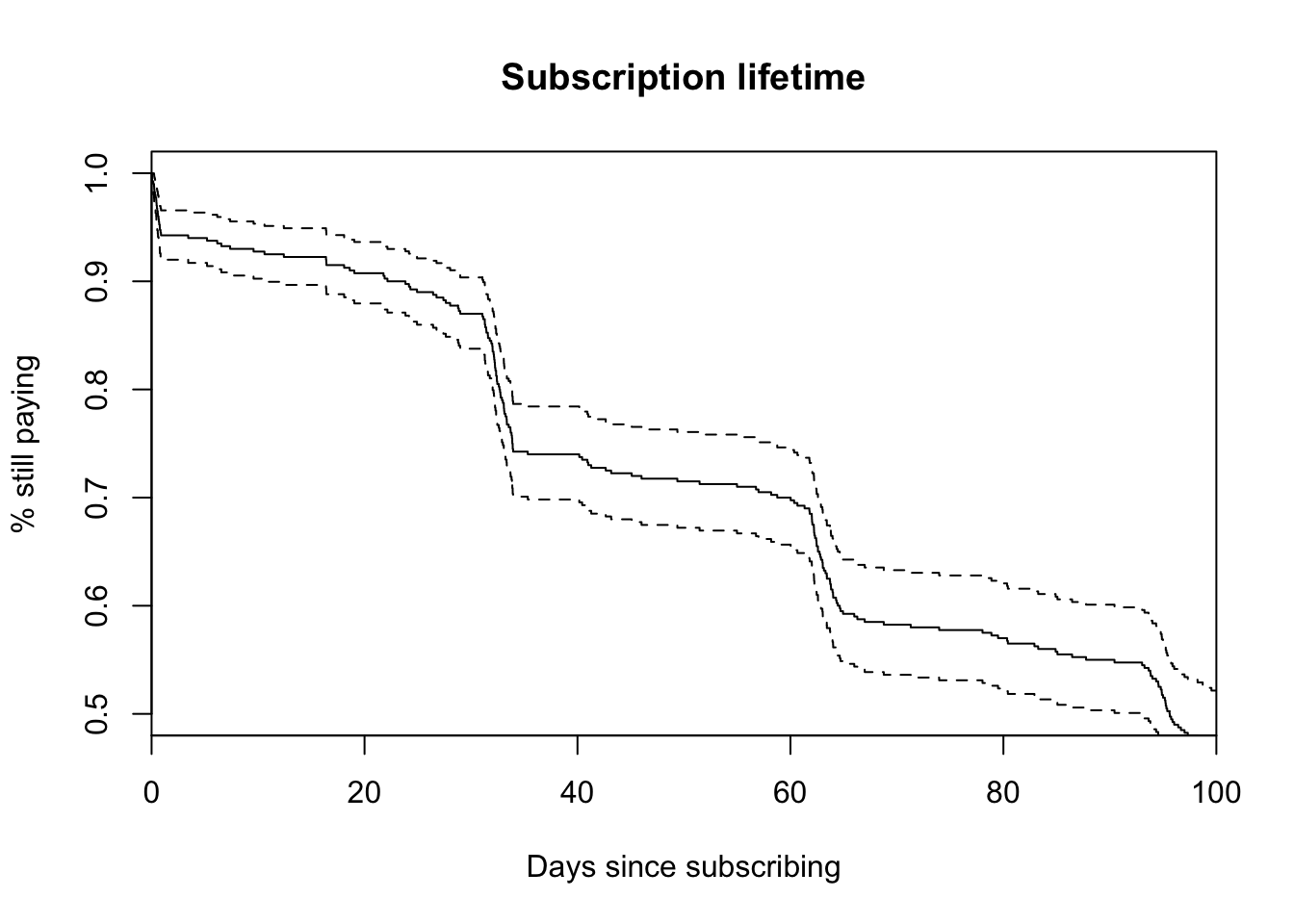

Typical parametric models will fail in the face of buyer’s remorse and billing churn, so we need something new.

library(flexsurv) # <-- awesome library; Christopher Jackson, you rock!

fitg <- flexsurvreg(

Surv(times, censor) ~ 1,

data = x, dist = "gengamma")

plot(fitg, xlim = c(0, 100), ylim = c(0.5, 1),

main = "Subscription lifetime",

ylab = "% still paying",

xlab = "Days since subscribing")

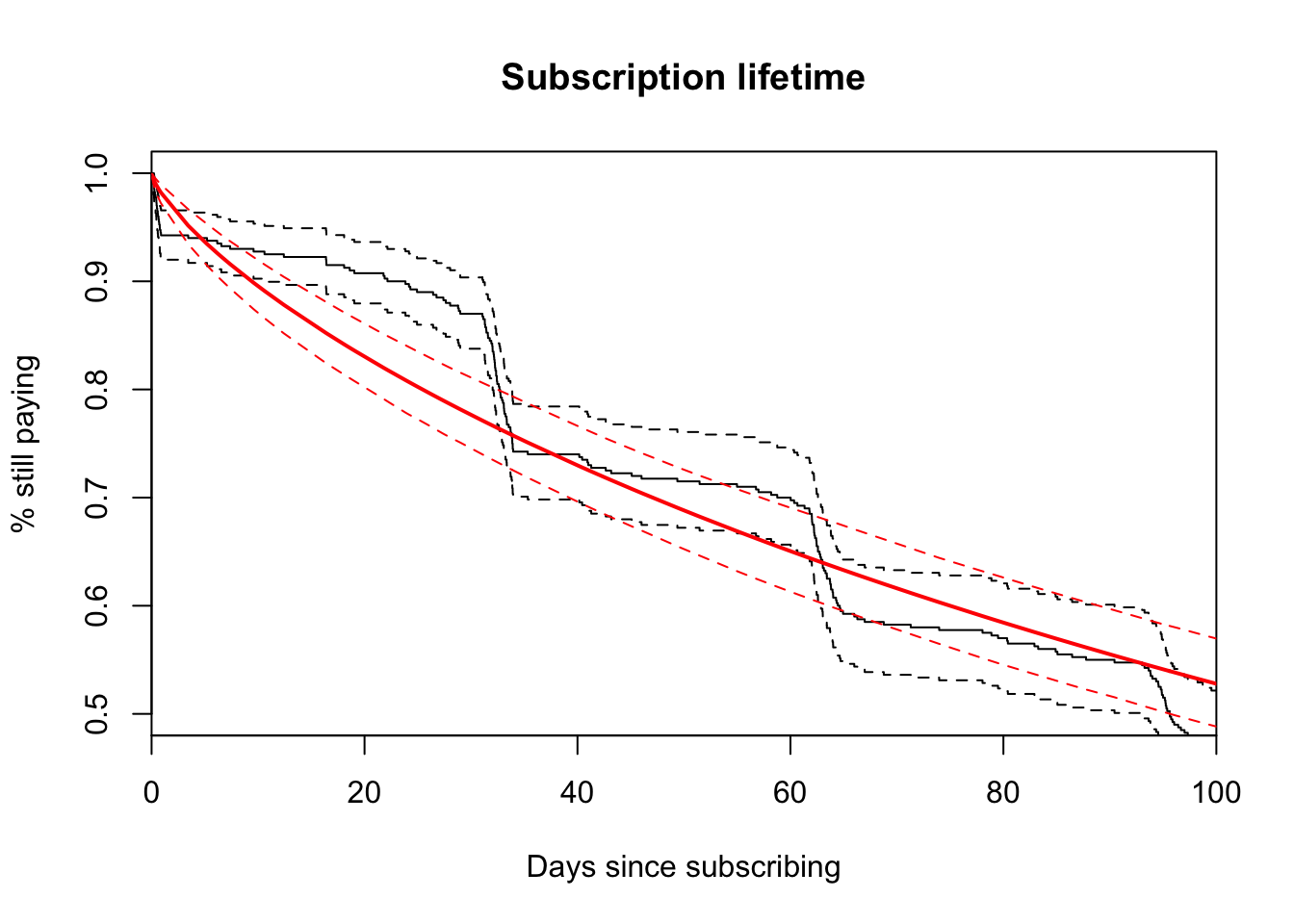

pfit <- phreg(

Surv(times, censor) ~ 1, data = x,

dist = "pch",

cuts = c(1, # initial purchase

31, 34, # second bill

62, 65, # third bill

93, 96 # fourth bill

)

)

survival_estimates <- function(x, xlim = c(0, 100)) {

if(x$n.strata > 1) stop("Developed for a single strata.")

ncov <- length(x$means)

npts <- 4999

xx <- seq(xlim[[1]], xlim[[2]], length = npts)

ppch(xx, x$cuts, x$hazards[1, ], lower.tail = FALSE)

}

estimates <- survival_estimates(pfit)

plot(fitg, xlim = c(0, 100), ylim = c(0.5, 1),

main = "Subscription lifetime",

ylab = "% still paying",

xlab = "Days since subscribing")

lines(

x = seq(0, 100, length = length(estimates)),

y = estimates,

col = "blue")

estimated_hazard_rates <- piecewise(

enter = 0, exit = x$times, event = x$censor,

cutpoints = c(1, # initial purchase

31, 34, # second bill

62, 65, # third bill

93, 96 # fourth bill

))$intensity… compare to our original example hazard rates,

data.frame(

actual = round(example_hazard_rates, 3),

estimates = round(example_hazard_rates, 3)

)## actual estimates

## 1 0.060 0.060

## 2 0.003 0.003

## 3 0.055 0.055

## 4 0.002 0.002

## 5 0.050 0.050

## 6 0.002 0.002

## 7 0.040 0.040

## 8 0.004 0.004Perfect! We don’t need statistics! :-p Since we’re specificing the random data upfront, we’re able to choose perfect cut points from a known distribution. It’s no suprise the model fits very well. In reality, we need to take this a step further by bootstrapping the estimates for a measure of uncertainty similar to our plotted parametric model. This is what we’ll want to deploy on our actual churn data.

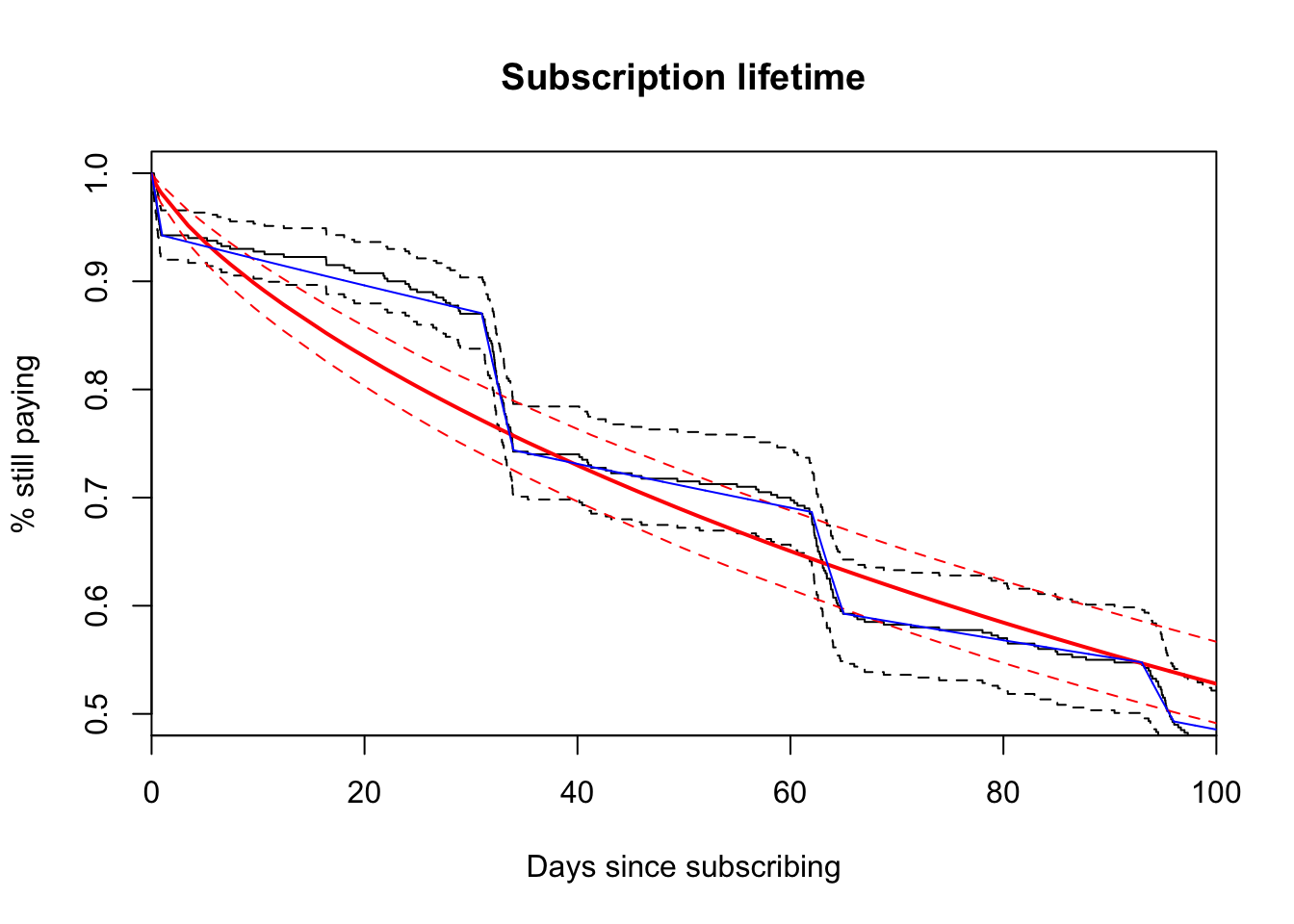

piecewise_fit <- function(d, i) {

survival_estimates(

phreg(

Surv(times, censor) ~ 1, data = d[i, ],

dist = "pch",

cuts = c(1, # initial purchase

31, 34, # second bill

62, 65, # third bill

93, 96 # fourth bill

)

)

)

}

library(boot)

library(dplyr)

library(reshape2)

pch_estimates <- t(boot(x, piecewise_fit, R = 100)$t) %>%

as.data.frame() %>%

tbl_df() %>%

mutate(index = 1:n()) %>%

melt("index") %>%

tbl_df %>%

group_by(index) %>%

summarise(lower = quantile(value, 0.05),

estimate = mean(value),

upper = quantile(value, 0.95))

plot(fitg, xlim = c(0, 100), ylim = c(0.5, 1), conf.int = F,

main = "Subscription lifetime",

ylab = "% still paying",

xlab = "Days since subscribing")

dashed_lines <- function(y) {

lines(

x = seq(0, 100, length = nrow(pch_estimates)),

y = y,

col = "blue",

lty = 2)

}

lines(

x = seq(0, 100, length = nrow(pch_estimates)),

y = pch_estimates$estimate,

col = "blue",

lty = 1)

dashed_lines(pch_estimates$lower)

dashed_lines(pch_estimates$upper)

Very cool. Now we’re on our way to accurately measuring churn. The piecewise-constant model assumes a steady exponential rate between each interval. It is a parametric model. This isn’t a terrible assumption with real subscription data, though and it gives the problem tractibility. If you want to deploy an experiment that targets days 31 - 34 (when customers receive the first bill), using a parametric model will yield statistical power for a faster turnaround. Also, we can see that the generalized gamma distribution, a distribution that includes many other distributions, can’t cope with the quick drops caused by buyer’s remorse and bills. The piecewise-constant model yields a great fit for this type of data and can enable high-precision experiments.